The demands of running a business are endless. As a small business owner, you’re responsible for overseeing daily operations, managing employees, handling financials, filing taxes, networking, planning marketing campaigns, making growth decisions—and that’s just the start.

It’s no surprise that many entrepreneurs experience stress and overwhelm.

One proven way to lighten the load is by outsourcing tasks that either fall outside your comfort zone or don’t require your direct decision-making. A virtual assistant (VA) can be an affordable, flexible solution to help you manage your workload while allowing you to focus on growing your business.

Tasks Commonly Outsourced to Virtual Assistants

Start by identifying which responsibilities you’re comfortable handing off. Many small business owners delegate tasks in the following areas:

Marketing Tasks

- Creating ads and promotions for traditional marketing outlets

- Developing content for social media platforms

- Responding to comments and messages on social media

- Creating and maintaining a marketing calendar

- Graphic design and video editing

Administrative & Back-Office Tasks

- Data entry

- Scheduling appointments and meetings

- Replying to customer inquiries and messages

- Invoicing and recording payments

- Paying bills

Bookkeeping Tasks

- Recording daily transactions

- Payroll processing

- Reconciling bank statements

- Maintaining ledgers

- Filing insurance claims

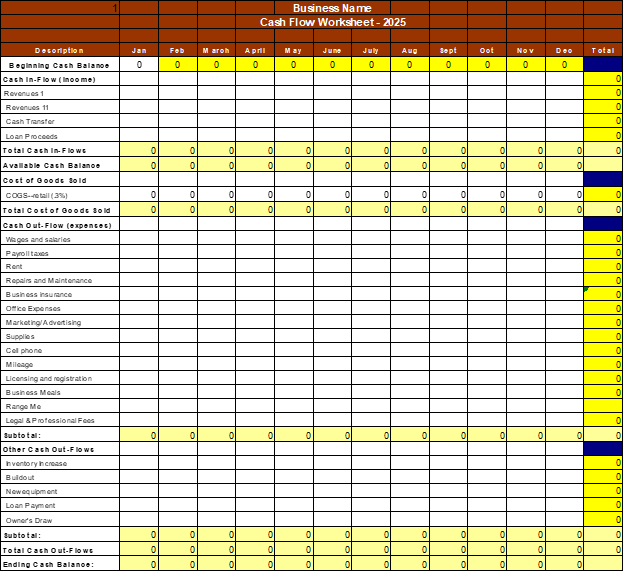

Financial Reporting Tasks

- Filing quarterly and annual payroll reports

- Filing monthly sales tax reports

- Running monthly profit and loss statements

- Developing cash flow analyses

Technical & Web Support Tasks

- Developing and maintaining your website

- Updating site links and plugins

- Providing IT support

- Overseeing cybersecurity

How to Hire a Virtual Assistant

If you’ve decided a virtual assistant might be right for you, follow these steps to get started:

1. Identify Tasks to Outsource

Make a list of the duties you’d like a virtual assistant to handle.

2. Estimate Time Requirements

Determine how many hours per week these tasks will require.

3. Research Pay Rates

Check the going rates for the type of work you need in both the U.S. and international markets.

4. Evaluate Your Budget

Decide what you can afford. If needed, prioritize only your most time-consuming or uncomfortable tasks.

5. Create a Job Description

Be clear about responsibilities and required skills—such as bookkeeping certification, social media experience, or website management. If hiring internationally, specify proficiency in English.

6. Search for Candidates

You can find virtual assistants through:

- Freelance platforms (Fiverr, Freelancer, Upwork)

- Virtual assistant services (Zirtual, Time etc., Belay)

- Referrals from your professional network

7. Screen and Interview Applicants

Look for:

- Relevant work experience

- Strong communication skills

- Proven reliability and time management

- Positive references

- Optional: assign a short test task

8. Onboard Your VA

- Set clear expectations for tasks and deadlines

- Use affordable project management tools like Monday.com, ClickUp, or Teamwork.com

- Provide regular feedback and encouragement

Final Thoughts

If you find the right virtual assistant and outsource the tasks that take the most time or cause the most stress, your workload — and stress level — can be reduced significantly. More importantly, you’ll free up valuable time to focus on the aspects of your business that only you can do.

While hiring a virtual assistant does require an investment, it can pay for itself in several ways. For example:

- A skilled virtual assistant managing your social media accounts can increase engagement and attract new clients.

- Delegating routine administrative or bookkeeping tasks frees you to spend more time meeting with clients, networking, or developing new services.

- An assistant handling website updates or email responses ensures customers receive timely attention, which can improve customer satisfaction and lead to repeat business.

When you use your reclaimed time to focus on revenue-generating activities, your business can become more profitable — turning your virtual assistant from an expense into an investment.

If you’ve ever hired a virtual assistant, I’d love to hear your insights and advice in the comments!

You must be logged in to post a comment.